Tales From the Oily Side

Starting a business isn't for the faint of heart!

My business card says “Founder.” It’s not a title, but more of a boast, an inside joke. I’ve had all the titles a man could want and as I settle into the long, hopefully comfortable ride toward the end of this long, challenging and exciting life, the word Founder on my business card describes the business activity I am most proud of.

Is this a great country or what? Where else can a guy start with nothing and create something? There isn’t any paved, well-lighted path to business creation, but there are no barriers to prevent anyone from doing it either. This is a story about creating a business. It would have been helpful to be a genius, or rich, or to have powerful backing. I didn’t have any of those things but I still managed to get the job done. I can attest to surviving many great risks and difficulties in the past two decades, and we’re still standing, hale and hardy. Part of the reason we survived was just luck. Part of it was having a good idea. Part of it was refusing to quit when any reasonable man would have. All of it was a hoot! I’m the Founder. I started it. I believe in it.

The beginning of Blackstone

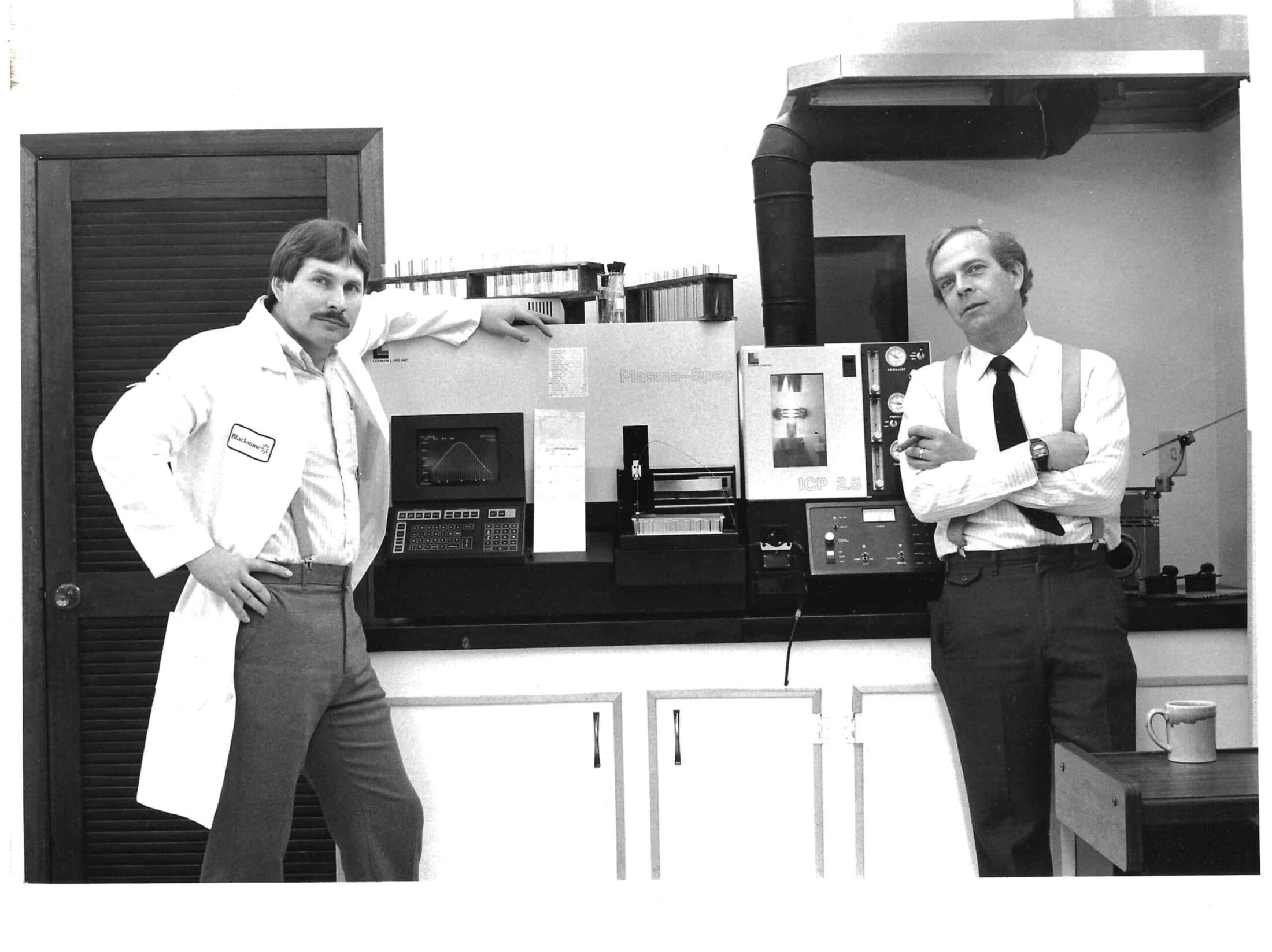

In the beginning I was sitting in a lawyer’s office in August 1985, incorporating Blackstone Laboratories. My wife was a full-time student at a private college and worked part time. We had some residual savings and stocks from past jobs, but after a month and a half of no employment, I was essentially broke. I was starting a laboratory business that I knew would be capital-intensive, with no capital. I had no clientele, no reputation as a businessman, and no place to open the doors. I was as alone as a guy could be and needed a lot of luck.

A lot of luck was awaiting me. Without it I would just have been another hapless hopeful with his shirttail hanging out, having lost his house, and returning to the dismal task of finding a real job in the world of work.

Incorporating Blackstone Laboratories was probably the most outrageous thing I have intentionally done. It made perfectly good sense to me and no sense to anyone else. My idea was to take oil analysis out of the full-service petroleum laboratory business and, concentrating solely on that one function, do it better, faster, and cheaper than anyone else. Ray Krok did it with the hamburger when he created McDonald’s. I wanted to do the same with oil analysis.

There are (I now realize) some obvious differences between Ray Krok’s idea and mine. When he started McDonald’s, Krok was already a successful businessman and had money and influential friends. His market was everyone who liked hamburgers, which includes nearly everyone on the planet. Even with all of this going for him, his journey into new business creation was not an easy one. Bankers, for instance, were reluctant to loan him money. At that time, there was no business category for “fast food.” To them, Krok was a restaurateur, but didn’t fit the mold for that type of business. They say there was a time that you could have bought half interest in McDonald’s for $50,000.

Good fortune

I could not have survived my early beginnings with Blackstone Laboratories without good fortune smiling on me. Early on, I was sitting in my back yard working on my business plan when who should mosey down my driveway, but my long-lost brother from Wyoming. “Hey, what’s up?” he asked. Bob was a graduate engineer beating the bushes for a new job, having recently been separated from a nice income by a West Coast power company. He pulled up a lawn chair. Sitting there beneath a maple tree on a fine, late summer afternoon, I outlined my plan for conquering the world with a better, faster, cheaper oil analysis program. He was off to Louisiana for a job interview and was thinking about visiting Alaska after that for the same reason. His parting words, as he made the trip back up the driveway was, “If you get the money, let me know. I might want to throw in with you.”

If Ray Krok had trouble with bankers, you can imagine the uphill battle I was facing. Bankers at least knew what hamburgers were. “Oil analy…what?”

The morning of the appointment to sign for the loans, I was sitting at the foot of my bed on a hope chest. As I was pulling on my socks, I realized my feet were ice cold. I was 42 years old and I thought surely, by now, I was past the point that I could come up “chicken” about any experience. Sure enough, I was literally experiencing cold feet. Once I signed those notes — along with my wife of the time, who took the plunge right along with me — I was embarking on this journey for real. The only possible outcomes were abject failure and bankruptcy, success, or death.

I got the initial loans approved for Blackstone not because of my brilliant business plan, my dazzling footwork, or my good looks. I got the money — far short of what I needed, I might add — because one of my neighbors was a commercial loan officer for a local bank. Why he was willing to go out on a limb for me I can’t tell you. Normally, bankers are not that adventurous.

Starting sales

Nothing happens in a new business until someone sells something. Just short of three months from the first day I began working on Blackstone Laboratories, we opened the doors in 600 square feet of rental space. About 80% of the loan money had been spent on new equipment and building renovation. Bob had come in with me, and with the help of many volunteers we fashioned a functioning laboratory and hung out our shingle. But wait! We didn’t have any oil samples to run. Money was flowing out fast enough, but nothing was coming back in.

Along with all the other activities of the past three months, I had been putting together a potential client list. At that time there were only a few places in our local business area that used oil analysis. Users typically had large diesel engines, critical factory machinery, or airplanes. Today, with everyone beginning to realize the importance of oil analysis, the market is vast. When we started you could list all the client possibilities within fifty miles of driving distance on one pack of index cards.

I called most of the “possibles” and made an appointment with anyone who would talk with me. The market greeted the coming of a new oil analysis company in town with little enthusiasm. During that first three months I didn’t actually have anything to sell. I built the potential client list by asking the question, “If I get my oil analysis business opened by November 1 and I can offer you the best oil analysis program on the planet at no more cost than you are paying now, will you consider using it?” That was a fair question that was hard to say no to. When they said yes, as most of them did, it gave me the perfect opportunity to set up the second appointment. But it didn’t get me any sure clients.

Money flows out of a business as steady as a beating drum. In order to survive you have to somehow match that outflow with income. While that may be intuitively obvious, it is a rude awakening when, after opening the doors of a new business you suddenly become aware that with each passing moment you are bleeding away your liquidity and have nothing coming in to replace it.

Just in case someone should actually call us or drop in, Bob stayed at the office. I went out to sell.

There was a semi-trailer manufacturer in town that had a garage to service their semis. The facility was Quonset huts of varying sizes attached together. I had visited several times and was certain they were going to buy our service. An unusual aspect of the place was this: to get from the smaller office Quonset hut to the larger one in which their maintenance work was done, you had to pass through the men’s rest room.

On the day I was to close the sale, Bob was along so I could show him the ropes. We met with the maintenance manager in the office. After a brief discussion the manager got up saying, “Well, if you want to work with us, come on” and headed into the men’s rest room. I started to follow when Bob grabbed my arm. “Wait a minute,” he said, “we don’t need business that bad!”

Working without pay

In the beginning, all the shoe leather I could spend didn’t produce thirty new clients in two months of dedicated work. Because we didn’t take credit cards, all the work we did manage to procure was with businesses that had to be billed. The invoice terms were net-30 but payments tended to arrive 45 to 60 days from the invoice date. I could only get invoices typed once a month. After our grand opening at the start of November, we didn’t achieve any cash flow income until after Christmas that first year. By Christmas I was flat broke. I had to go over to Bob’s house one evening and confess. The bank account was tapped out. There would be no more paychecks until we got business rolling. “Think it over. Are you willing to come back to work January 2 with no income? In or out…let me know.”

Bob stayed. For the next year payday became a function of finding ways to pay bills with little to no income. I personally borrowed from every source possible until eventually no one would lend me any more. It took a year of hard selling to get enough income to pay bills even without payroll. Sometime during the second year of operations we managed to eke out enough to pay Bob and myself $100 a month.

Entering the computer age

As sales increased, so did the physical requirements of typing reports and invoices. Bob ran the samples. I took care of nearly everything else. We reached the point of sixteen oil samples a day sometime in the second year. We had no computers and no money to buy any. If I started typing reports at 1:00, I could produce the sixteen (perfect) reports by 10:00 that night. The reports were three -part NCR paper, so any typos meant I had to start over typing a new report. My typing skills left a lot to be desired.

Late in the second year a mildly rotund gentleman with a round beaming face strolled in our front door. He was starting a new computer hardware/software company and needed business. I needed a computer and a program to run it. We made a deal. With his help, we managed to build a functioning computer system that could produce a perfect Blackstone oil report. It multiplied my report capabilities several times over. When we added the invoice function the following year, we had a system that could comfortably produce fifty reports a day.

The poor years

I come from a family of seven children. We grew up without having much other than the community of family closeness. In his autobiography, Ray Charles speaks of poverty: “Poverty knits people together. Affluence has the opposite effect.” Being desperately broke in the early years of the company’s development and working closely with Bob had a familiar ring to it. We were certainly a nonprofit business without having the tax benefit of being such. Business grew slowly, though we were never without things to do. One of the problems was neither of us could get any time away from the business. He didn’t have many oil samples to run, but they needed to be run every day. I had to be on the property every day to report the data and take care of the other aspects of running a business. Typing reports usually happened late in the day, after being on the road selling all morning and afternoon. Bob decided we needed another person so we could get the occasional day off.

Sometime in the second year, my brother John started hanging around the lab. Bob, who couldn’t stand to see idle hands, put John to work. John had sick leave income so was doing better financially than the two of us. He learned one lab job, and then another. He eventually was running the lab, freeing Bob up to do other things, including getting the new computer system up and functioning. For a while, John’s appearance was spotty, sometimes working at a factory, sometimes at Blackstone.

Then one fine fall morning, John showed up at Blackstone to work full time. While we needed the help, there was no money to pay him. We were not in any position to put anyone on the payroll since we really had no payroll. But John was family and was showing faith in what we were trying do to, so I welcomed him to the operation and tried to figure out how we were going to support him.

During the first year of operations I had invested several thousand dollars in Blackstone. Most of it was borrowed. Our revenue had grown to the point that I drawing some of that money back from the company and was getting some of the loans off my back. In order to support John I simply diverted the loan payment money to him for income.

Driving beaters

John had always driven “beaters” for transportation. When something, anything, went wrong with one of them, he would simply abandon it and buy another. Anything that was transportation was okay with him . When he started at Blackstone he was driving a rusted out AMC Hornet. The company bought me a Jeep pickup truck since I had to be on the road selling and my problem-ridden Jaguar had died. John’s Hornet died so I gave him the company pickup to drive and bought another Jeep, an aging Wagoneer from a car lot.

The only reliable set of wheels between the three of us was the Jeep pickup. When either Bob or I broke down, John would get the call to tow us in. Having had the experience of being on the strap behind John once in my life, I had no desire to do it a second time. Towing is a two-person function if it is to be done safely and successfully. With John up front you were sort of on your own. It wasn’t that he forgot you were back there. He would simply set off and navigate traffic as if he didn’t have a care in the world.

Returning from a late fall, family campout in southern Indiana, Bob suffered an electrical failure in his wife’s aging Toyota fifty miles short of home. John got the call. He found Bob along the berm of the northbound interstate lanes. John hooked Bob up to the strap and lit out in a cloud of dust. Everything went well until John swung out to pass a semi tractor-trailer rig at highway speeds. When Bob steered left to follow, the steering locked since he had forgotten to turn on the ignition. There followed the wildest ride of his life. The Toyota swung left as far as it could go, then swung back to the right, threatening to tunnel itself under the semi. It stopped short and swung left again. Bob was sliding back and forth in ever increasing arcs and there was nothing he could do about it. John continued the pass and a final hard swing took both of them to the ditch, fortunately upright. Bob was speechless. It took awhile before he could pry his white fingers off the steering wheel.

Price matters

We continued to build Blackstone by saving engines in cars, trucks, airplanes, and factory machines. Our clients stuck with us because our program really worked. We saved them money, it was as simple as that.

Selling it was another matter. You can be the best and know you are the best but still have trouble convincing new client prospects. Our defensive position was to maintain our current client list by saving them money. Our offensive position was pounding the bricks with all the energy I could muster up and still get into work that afternoon to get the reports out in a timely manner. There was intense competition out there for the limited numbers of businesses that used oil analysis. We were the best but not the cheapest, and cheap seemed, at least at the time, to turn more heads than did quality. The benefits of using our quality program were so great that I thought the cost of the oil samples was incidental. The problem was convincing new clients of that.

At first I tried selling oil analysis at the same price as my competitors. Most of them had subsidized programs, meaning they had another source of income, like oil or equipment sales, and could provide oil analysis at an unrealistically low price, often half of the cost of actually processing the oil sample. As an independent laboratory we had no such advantage. Competing price-wise was the shortest possible path to bankruptcy. I had to raise prices or cease to exist. We did that in short steps until we finally got to the point that the volumes we were running could support the company and the three of us, if we didn’t expect much income.

Enter Craig

Sales grew quickly in the first three years, but fortune really smiled on us when Craig joined us as a commission-only salesman. Craig was between jobs and marriages and was an acquaintance of John’s. Always open to a new product or idea, Craig stopped by one day to see what we were up to. It was our third year of operation. He found our approach to oil analysis exciting and decided he could bury us in oil samples in a short period of time. I’d heard it all before, but having been out there pounding the bricks myself, I was willing to try anything. Craig was different in a charming way. A moderately tall, bright-eyed, lanky young man with prematurely graying hair, he was a guy women wanted to hug. There were times I wanted to hug him myself.

If the Greek derivation of the word enthusiasm is “god within,” Craig was blessed with an entire committee of gods. He liked to laugh and it was fun laughing with him. We talked about where we might find new business and he decided it was factories, which were the biggest users of oil of all the companies that used oil analysis. I’d had good luck with factories and had several as clients.

We had a Ford factory in the Toledo area that sampled stamping machines regularly. We found a mechanical problem on one of their presses right before the 4th of July holiday. When they checked the oil reservoir they found parts of a gear. They managed to fix the machine over the holiday and lost no production. Had the machine failed during a production run, they estimated their losses would have been about $5 million. They paid us $15.00 for the analysis report. That’s a nice payback, no matter how you look at it.

Craig looked around and decided to target the automakers’ factories and those of their suppliers. The Motor City was within driving distance. After working the phones for a few days, something Craig had a wonderful knack for, he set out at his own expense to sell them.

Oil analysis was not widely used in factories at the time so he didn’t run into the competition that I had been butting heads with in other market areas. While I placed articles in trade journals, Craig knocked on doors, piquing interest in how much money the industrial guys could save with oil analysis

We had three months with Craig working full time, and during that time he brought remarkable progress to our program. His income on the commission-only basis was not growing fast enough to support both him and his ex-wife, so he eventually went to work selling roofs for a company that could pay him more. He stayed on with us, however, part time. He and I did a lot of traveling together in the next couple of years, doing presentations along with direct sales. Craig was, and still is, a remarkable individual. He will never be accused of being a small thinker. At one time he tried to sell the U.S. Air Force. I know. I was with him. They actually talked with us. We didn’t get the sale. (Just for the record, the U.S. Military does its own analysis. As we understand it, every military aircraft has an oil sample done before each flight.)

If Craig was the maestro, I was at least the saloon piano player. I saw firsthand what a professional sales person could do for a fledging company. We grew like wildfire until the recession of 1989. Those were heady years. We established decent incomes, upgraded the facility and eventually bought the building we were in. All three of us were driving company cars, though none of them were new or particularly reliable. From 1985 until 1989, I felt like we were achieving success.

The tide goes out

As surely as the tide rushes in, it reverses and ebbs back out again. Auto sales plunged in 1989, and the automakers and their suppliers contracted to bleak austerity. They work in a cyclical business, and roughly every three years (at least back then) they worked a boom and bust market. It was like a well-choreographed dance. When hard times came to call, they would cut all non-essential spending, including oil analysis. In the short span of three months, we lost nearly 50% of our business.

Craig drifted away and eventually moved to Colorado and remarried. I thought we would recoup the factory business when the recession ended, but it wasn’t to be. The oil companies, which provided cheap (read: subsidized) oil analysis programs, moved into the gardens we had cultivated. The automakers and their larger suppliers instituted new purchasing schemes that precluded working with a company as small as Blackstone.

Once the dust settled and I could clearly see where we were, we began trying to rebuild the dream. We had successes and failures, like any business. Competition had intensified during the long drought of ’89–’92. Many of the traditional markets we had been working in were occupied with new squatters. I found new ways to sell, but there were long periods of time where I couldn’t make much progress. For the ensuing half-decade we always had a main customer or two that sustained us, but it became increasingly difficult to maintain payroll and keep our aging equipment running. For the longest time, the magic was gone. We existed but we couldn’t seem to grow. Sales peaked in ’91, then flattened out and didn’t make any real progress until ’97.

Personally, things got equally as tough. Both my kids were headed off to college, my daughter to Indiana University, my son, two years later, to Purdue. If you haven’t had the experience of getting bursar bills unexpectedly, along with other miscellaneous charges from the university, you haven’t seen hard times. We had no plans or savings to cover the expenses, so we just muddled along, paying costs out of cash flow, which, while adequate for the four of us living together minimally, was hardly adequate under the new circumstances. We got by but I don’t know how. Much of it was my kids’ willingness to work and do whatever was possible with limited funds.

My wife and I eventually divorced. Then my brothers and I had a falling out. We had worked together a decade and though we had a lot of good times together, and we could not have gotten that far without all three of us, it became clear that unless something changed, we would eventually fail. Bob left first and eventually bought a small town newspaper, which he has turned into a successful operation. John retired to his workshop.

Turning point

In August 1996 I was just getting started rebuilding a two-acre farm property that my fiancé Sue and I had pooled our money to buy. Two weeks after moving in, Sue and I were married in the front yard. That was one of the few bright spots in an otherwise dismal stretch of time that had begun in 1991. I didn’t know it at the time but it was also a pivotal point in my life and the life of Blackstone Laboratories.

My daughter Kristin had graduated from Indiana University with an English degree and moved to Colorado. She had found happiness and success in magazine editing. My son Ryan had graduated with a mechanical engineering degree from Purdue University. He had interviewed for engineering work but hadn’t decided on anything definite.

While Blackstone hadn’t fallen into complete disarray, we had, for a very long period of time, established a pattern of no progress. We would win some and lose some, but there was no significant growth for six years. The dream wasn’t dead but it was seriously tarnished for most everyone with whom I was associated, business or personal. Except for one person.

Unbeknownst to me, Ryan, who had been on the outskirts of the business since the company started when he was 12, knew as much about Blackstone as anyone alive. I thought he would probably take an engineering job, maybe far away from home, and pursue his own life. He could have done that with my blessing.

One evening in August 1996, Ryan and his fiancée, Sheri, were over for a cookout. After dinner we were relaxing in my back yard when I asked Ryan what his plans were for the future. He said, “Well Dad, I thought maybe I’d join you to help build Blackstone.”

I was stunned. Here was a bright young man with great earning potential, saying he was willing to come work with me knowing I could hardly pay him a livable wage. I told him I would see what I could do. It took awhile, but on April 15, 1997, he went on the payroll at about a third of what he could have made elsewhere.

John was still running the lab at the time, and I’d brought Sue in to run the front office and accounting. With Ryan on the property there were four of us. We didn’t have much to show for twelve years of operations. Our equipment was aging and there was little money with which to replace it.

We had only one computer to write reports on, and it was tied to an old printer that we couldn’t get parts for. The original programmer was still around to help when an emergency came up, but he was never more than a moonlighter and had less and less interest in helping out.

From the moment Ryan first set foot on the property, the old start-up magic began creeping back into the company. His approach can be summed up with a statement he often made at the time, “Whatever it takes, Dad, whatever it takes.” I had company in my desperate situation and Ryan didn’t see it nearly as desperate as I. We had a business. We had cash flow. Working with him was refreshing. I had an inkling that we just might get the company back on track.

The old magic returns

I found a spectrometer in Detroit and the financing to buy it. That solved the problem of aging equipment. Ryan drove up to New Hampshire to spend a week at spectrometry school. He camped out in a tent in late October to save us hotel expense. When he got back he put the new machine in gear and, for the first time in history, Blackstone had an expert in spectrometry on the payroll.

It was wonderful to have a bright-eyed, enthusiastic young man to work with. He was interested in all phases of the business and took many chores of the operation into his office. We started making progress. Ryan set up new processes and systems that improved our efficiency. He solved many of the problems that had made us fragile. I had less to worry about and work became fun again. The mood of the company improved. There seemed to be nothing Ryan wasn’t interested in and nothing he couldn’t do. He was the first person I was ever able to teach the report-writing process to.

We had been on the Internet for some time. Selling oil analysis via the Internet was John’s idea. He’d heard about a guy who sold buckets using this new medium. There was nothing special about his buckets and they weren’t even cheap. But he became a huge bucket salesman with his Internet sales.

I agreed we should give the Internet a try. With the help of a computer-savvy nephew, Bob and John had started and administered a website. It wasn’t very good but it did generate interest, some of it international. Though it wasn’t expensive as a sales tool, it didn’t make us any money in those first few years either. Being in the throes of a perpetual cash shortage, I thought many times about discontinuing the website. When I mentioned this to Ryan, he thought otherwise.

By making it more informative and user-friendly Ryan thought we could make the website productive. We reorganized and rewrote it and had a professional reestablish our presence on the web. The result was amazing. The growth of the Internet during that period was incredible. More people had home computers, and our presence on the Internet meant oil analysis was available to the general public for the first time. More people became aware of what oil analysis could do for their personal cars and trucks. To use an analogy, for the first twelve years of our existence, we were trying to throw a basketball into the hoop from the far end of the floor. Using the Internet, we began throwing basketballs into a canyon standing on the rim. We can’t throw them in fast enough, nor is there any chance, in my lifetime, that we will fill the canyon up.

Upgrades & hiring

The software that originally got me past hand-typing reports and invoices was still in use when Ryan started. During his four years at Purdue’s engineering school he had become familiar with computers and networking. I don’t think it would be an exaggeration to suggest he was appalled by the antiquated system I had been limping along with.

Sales were improving, so he hired an outside contractor to build the foundation of a new database system. After a few months that company became too aggressive with their billing practices so we had to undertake the project in-house. Ryan tackled this project too, taking some courses to learn how to program and hiring a full-time programmer to help complete the project.

Early in 2002, sales were booming. I had my back against the wall — even with Ryan’s help I was writing so many reports every day that it was physically getting me down. If you’ve used our oil analysis program, you know we write individual comments for every report. If I had to keep typing reports at the rate I was, I was going to be worn out completely. We needed another analyst who could pick up report writing and some of the other aspects of the business.

“What about Kristin?” I asked, one rainy night as Ryan and I were making our way our to our cars after another long, hard day. It stopped Ryan in his wet tracks. “I’ll think about that,” he replied. By the next morning we were working on the idea of possibly bringing Kristin into the business.

Kristin and her husband were living in Michigan. She was managing editor of yet another magazine. They had recently relocated from Colorado and were settling into a new life and home. At first I didn’t think there was much of a chance of getting Kristin into the company. But after some discussions, she joined us in April 2002. As it turned out, Kristin not only proved to be an expert report writer, but she picked up many of the other business functions that were overloading the rest of us. Today, Kristin is a vital part of the business. She is not only the report writing champ, but manages virtually all of the non-direct operating functions of the company including the website and newsletter.

Kristin and her husband were living in Michigan. She was managing editor of yet another magazine. They had recently relocated from Colorado and were settling into a new life and home. At first I didn’t think there was much of a chance of getting Kristin into the company. But after some discussions, she joined us in April 2002. As it turned out, Kristin not only proved to be an expert report writer, but she picked up many of the other business functions that were overloading the rest of us. Today, Kristin is a vital part of the business. She is not only the report writing champ, but manages virtually all of the non-direct operating functions of the company including the website and newsletter.

Saving engines

We have always had the technical ability to save engines and other mechanical systems from failure. As sales grew we saved more engines. As our saves increased, so did our reputation. When we save an aircraft engine it is often a life-and-death matter. When the save is an industrial machine, it can save millions of dollars in downtime. When it is a car or truck engine, it adds many years of useful life to the vehicle and is equivalent to putting thousands of dollars in a client’s pocket. When you compare the cost of an oil analysis to the potential savings, the payback is tremendous.

Looking back on two decades I can see turning points that brought us through perilous junctions in a long journey. Some of it was planned but much of it was sheer luck (or fate, if you will). There are nearly 300 million people in the U.S. alone, who own twice that many cars, trucks, boats, and airplanes. To keep those transportation systems alive and well, they need oil analysis as much as people need doctors. It is our job at Blackstone to make our technology as commonly known and accepted as X -rays and MRIs. We are doing that and the result is a phenomenal, modern-day success story. Is this a great country or what?

Pardon me for the long story. My business card says “Founder.” I’m proud of my kids and all they’ve done to make Blackstone the great and growing company it is. I’m proud of our technology and that we can make it easily understood. We don’t have a doctor to interpret laboratory results. We are the doctors.

Looking ahead

Jim is no longer with us; he passed away peacefully at his home in November 20, 2015.

But his dream lives on.

Blackstone has customers from all 50 states and over 75 different countries on six different continents, and we’re still growing. It’s been a great ride so far, and it ain’t over yet.

Related articles

What is a Flashpoint?

The flashpoint looks for fuel in the oil

Spectrometry: The Marvel of the Lab

Using the 4th state of matter to see what's in your oil!

What are Insolubles?

How good a job is your oil filter doing?

Particle Count Test

Breaking down the mysterious ISO Code